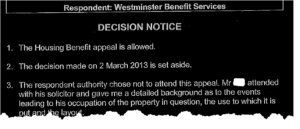

On 20 September 2013 Robinson Wilson Solicitors assisted in securing a First Tier tribunal regarding the Housing benefit under occupancy regulations, commonly know as ‘bedroom tax’. By way of background, the local authority, in this case, Westminster made a decision in March 2013 that the appellant (assisted by Robinson Wilson Solicitors) had one additional bedroom and therefore it must apply the statutory reduction in his housing benefit entitlement.

The appellant and Robinson Wilson Solicitors argued that the room in question was not a bedroom and had never been used as such, as it contains necessary equipment to help him with his disability. Further that his home had been specially adapted for him to meet the needs of his disability.

Judge C Haley-Halinski allowed the appeal. In his decision he stated that the term bedroom is “nowhere defined and I apply the ordinary English meaning. The room in question cannot be so described.”

Although decisions of the First Tier tribunal are only binding on the Secretary of State, in the absence of a binding precedent this case should be considered favorably, as to our knowledge it is the second case to succeed in challenging the term “bedroom”. The only other tribunal case on this point to succeed is SC108/13/01318 (held in first tier tribunal Kirkcaldy Scotland)